Comment Letter: Updated Definition of Waters of the United States (WOTUS)

Comments on proposed changes to the Clean Water Act definition of Waters of the United States.

Four Comment Letters on ESA Proposed Changes

Comments on the Fish and Wildlife Service and NOAA proposed changes to the Endangered Species Act.

Government-Run Offsets Gone Awry

Comment Letter: Colorado’s Regulation No. 87 for Permitting and Mitigating Dredge and Fill Activities

Comments on Colorado’s draft Regulation No. 87 for permitting and mitigating dredge and fill activities

Predicting DOGE AI Deregulatory Tool Recommendations

Comment Letter: Nationwide Permit Reissuance

Comments on “Proposal To Reissue and Modify Nationwide Permits” (COE-2025-0002)

Green Finance Institute: Revenues for nature announces global effort to unlock private sector finance for nature restoration and conservation

Some Myths and Misunderstandings in Biodiversity Credit Markets

Biodiversity credit markets are new and unfamiliar to most of us, and misconceptions abound. Because carbon credit markets have attracted so much attention - good, bad, and ugly, there is a (mostly) false impression that carbon markets are, or should be the single model for a biodiversity market, and that couldn’t be farther from the truth. I spoke recently as part of an excellent series on biodiversity credits hosted by the Environmental Leadership Training Initiative, and below I’ve adapted my comments from that event to address some of the myths and doubts often posed by both advocates and skeptics. If others come to mind, go ahead and throw them in the comments below.

Fun Tidbits I Learned While Researching US Biodiversity Markets

New Report: Building a Thriving Biodiversity Credit Market

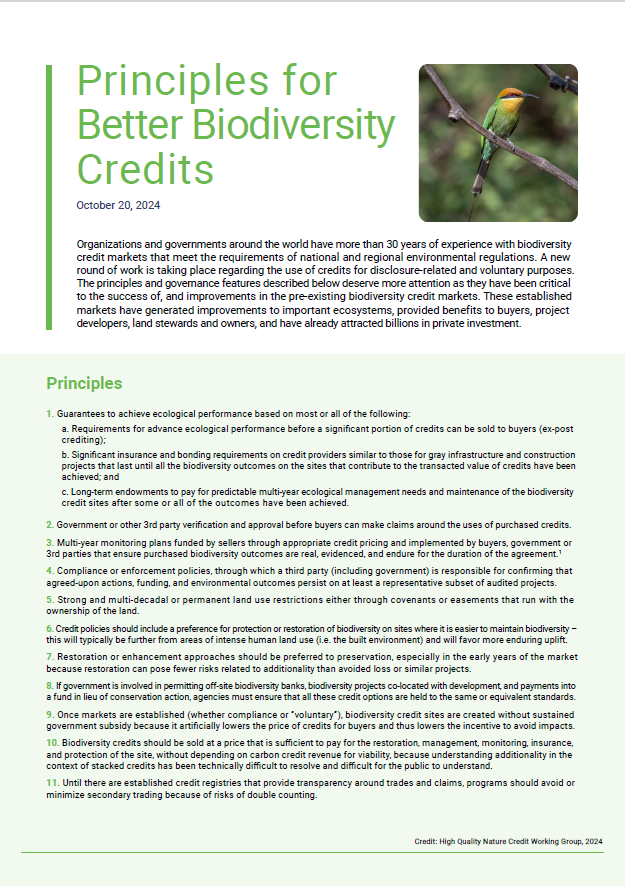

Biodiversity Credit Principles

Building a Thriving Biodiversity Credit Market

Beetles in a Pay Stack: Stacking and Bundling in Biodiversity Credit Markets

Why Offsets on Public Lands is a Bad Idea

What do they want? Biodiversity Credits. When do they want it? Soon!

What is motivating biocredit buyers at this early stage as the market is in development? Why would corporate buyers and other entities be interested in investing in migratory songbird or salmon credits? What’s in it for them? Today the BCA released a new issue paper, “Demand-side Sources and Motivation for Biodiversity Credits'' that untangles some of these incentives and rationales.

Three Steps Forward for Species Mitigation in 2023

Conservation Banking in California: A Review of CDFW Approval Timelines and Insights from Stakeholders

3 New Changes for Offsets under ESA Section 7 and 1 Very Old Holdout

New Paper: Biodiversity Net Gain