Probably More Than You Want to Know About SRF Compound Interest

In my previous blog, I discussed how State Revolving Funds (SRFs) interest rates and fees can impact total costs to municipal borrowers. States have a lot of choices in how they administer these loans, for example by forgiving a portion of them, providing low borrowing costs even when towns and water utilities have a poor borrowing history, and providing flexibility on interest payments and fees. Collectively, these programs offer hundreds of thousands of dollars in discounts compared to what utilities and other municipal entities would pay if they borrowed through traditional financing mechanisms. As I noted in my previous blog post, choices the state SRF programs make just on interest rates and fees can lower borrowing costs by 5-10%. For the utilities that qualify for it, states’ approaches to loan forgiveness can make an even bigger difference.

States also have a choice in how to set policies around disbursement requests from loans and the impact of accrued and capitalized interest. These policies might only make another 1-2% difference in the total cost of borrowing, but combined with the estimated cost impacts from the previous blog on a $5 million hypothetical loan, they can add an additional $300,000 to $600,000 in financing costs. Those amounts are not insignificant, and a loan recipient could otherwise use those dollars to support necessary utility operating and maintenance costs or other capital improvements over the duration of the loan.

The focus of this second part of my analysis of SRF financial terms is to look into these aforementioned hidden costs of borrowing and explore some strategies for prospective borrowers to consider as they plan for project financing and construction timeframes.

Compounding Interest and Its Impact

Compounding interest refers to the process of adding interest to the principal amount of a loan. In compounding,over time, the interest itself also earns interest. This compounding effect can significantly impact the overall cost of borrowing and repayment obligations for loan recipients. The impact of compounding interest on the loans offered through states’ Drinking Water and Clean Water SRF programs can include:

1. Long-Term Debt Burden - Since water infrastructure projects often require substantial financing, the compounding interest on these loans can result in a considerable long-term debt burden for borrowers. Therefore, it becomes imperative for borrowers to carefully assess their ability to manage debt obligations before accepting funding through these programs.

2. Affordability of Water Projects - High compounding interest rates may limit the affordability of water infrastructure projects for some borrowers, particularly those whose residents have constrained financial resources. Unfortunately, while a borrower can adopt programs and policies to address affordability for vulnerable residents, they often do not have the capacity to do so, and decision makers’ concerns about affordability may hinder essential water quality and safety improvements

3. Capitalized Interest - Where allowed, some SRFs permit the deferral of interest-only payments during the project construction period. Instead of making regular interest payments, the interest on the loan accrues and is capitalized (in other words, added to the outstanding principal of the loan) once construction is complete. This highlights an important policy consideration, as capitalization of interest payments can increase the annual debt service owed over the life of the loan, as illustrated below.

4. Benefits of Timely Repayment - On the flip side, timely and consistent loan repayments, and choosing to begin interest and/or principal payments early where allowable, are options borrowers can use to mitigate the impact of compounding interest, as these practices reduce the overall interest accrued.

Mitigating the Impact of Capitalized Interest

This gets complicated fast, but hopefully the following charts and tables show the impact of compounding interest and the effect of such accrual over a loan drawdown period prior to repayment.

SRF programs provide loan proceeds to borrowers on a reimbursable basis. In other words, as a utility incurs costs for a project, they submit documentation for the charges to the SRF administrator, who then fulfills the request for a draw of loan proceeds. The drawdown period is the time between the initial loan award and the final request of the total loan balance from available proceeds. Interest begins accruing on only the amount of the first draw of funds when they are paid to the borrower. While SRF policies and repayment procedures may vary, generally there are two options for borrowers during the drawdown phase of the loan: 1) make interest-only payments on the loan proceeds until drawdown is complete and the loan begins amortization; or, 2) defer interest payments and allow interest to accrue and capitalize, rolling into the principal of the loan. Just like in my previous blog post, the following scenario assumes a $5 million principal loan award at 2.5% interest, with a 20 year repayment period.

Fig. 1

As shown in the above chart and table below, assuming the borrower draws proceeds semi-annually from a $5 million SRF award over a two-year project construction period, total principal and interest due to the compounding effect would amount to $5,111,250. Once the hypothetical two-year drawdown period ends, the amortization (or monthly schedule of principal and interest payments) begins, and the accrued interest ($111,250) over the drawdown period is then capitalized and included as part of the principal amount. The total amount financed over a twenty-year repayment period would then be $111,250 higher than the original $5 million loan amount (Fig 2).

Fig. 3

At an awarded loan interest rate of 2.5%, the total cost impact to the borrower is $6,500,319 due to the compounding effect over the amortization period and the capitalized interest accrued during the drawdown period.

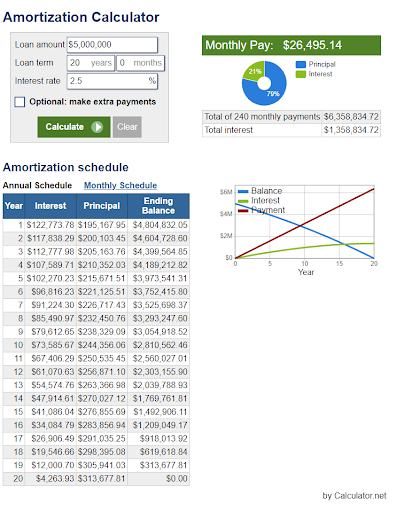

Some SRF programs alternatively allow for interest-only payments to be made during the drawdown period as opposed to capitalizing interest. Below is the hypothetical amortization of a $5,000,000 principal award with no capitalized interest (Fig. 3).

When compared to the previous scenario involving compounding interest, the total cost to the borrower here is $6,358,835, representing a $141,484 savings in debt service over the term of the loan. While that amount may seem insignificant for a twenty-year loan, these amounts would be higher with larger projects and/or higher interest rates as market conditions change. It is also important for the long-term financial health of a utility to minimize debt obligations in order to meet rate covenants imposed by other debt, plan effectively and strategically to cover increasing operations and maintenance costs, and responsibly plan for replacement of capital assets using a mixture of cash and debt.

Solutions

Various strategies can help address the challenges posed by compounding interest on DWSRF and CWSRF loans:

If a borrower has sufficient cash-on-hand or cash flows to fund the project through the construction phase, the entire award could be drawn down after all project costs are incurred. This means that the amortization clock would begin immediately rather than a slower drawdown period with accruing interest or interest-only payments during that time.

Refinancing - Borrowers can explore refinancing if they find themselves facing higher interest rates or unfavorable repayment terms. Refinancing could potentially secure better terms and reduce the overall cost of borrowing. The borrower could refinance through the SRF itself, a direct bank loan, or a bond issuance depending on economic conditions and market interest rate climate.

Project Planning - Robust project planning that considers a range of alternatives can help identify lower cost, financially and environmentally resilient, and community-centered projects.

Financial Planning - Robust financial planning is crucial to assess the affordability, feasibility, and priority of water infrastructure projects. Proper financial projections can help borrowers gauge their ability to manage loan repayments effectively. Use of a combination of fund equity and available cash flows in conjunction with debt service can significantly lessen the total borrowing need. EPIC’s Funding Navigator and other WaterTA providers can assist underserved and overburdened communities and the municipalities and utilities that serve them with project and financial planning.

Balancing Grant and Loan Funding - Utilizing a combination of grant and loan funding can reduce the debt burden for borrowers, as grants do not require repayment and can help offset interest costs. Grants may be in the form of principal forgiveness subsidy through the SRF program or other federal and state grant programs available for water infrastructure.

The variation of interest rates with DWSRFand CWSRF loans has a substantial impact on water infrastructure projects' affordability and long-term sustainability. The compounding interest effect magnifies the importance of careful financial planning, proper project assessment, and timely loan repayment by borrowers. Policymakers and water authorities must continue to monitor and adjust interest rate structures to ensure that these essential funds remain accessible and effective in supporting the nation's critical water infrastructure needs.